Get the Estimated Cost for Your Mobile App Development Project Now with our Cost Calculator.

Get a Free QuoteBlockchain

Blockchain technology minimizes fraudulent activities, strengthens compliance, and builds long-term trust between insurers and policyholders.

Image Recognition

Image recognition technology streamlines claims verification and automatically analyzes photos of damaged property, vehicles, or medical documents.

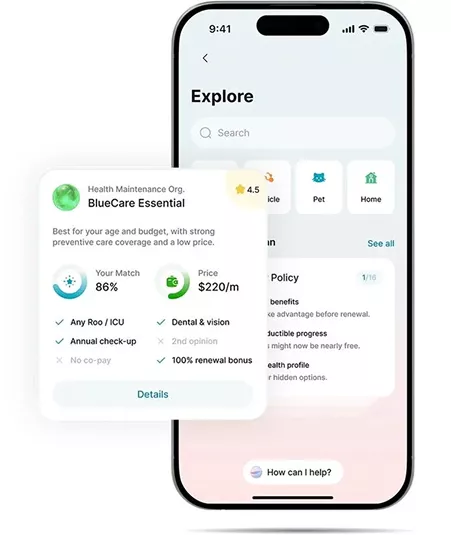

Artificial Intelligence

AI chatbots and virtual assistants accelerate customer support, respond to queries 24/7, and even guide users through policy selection or claims filing.

Virtual Reality (VR)

Virtual reality provides immersive training experiences for insurance agents, helping them handle real-world scenarios, policy explanations, or emergency preparedness effectively.

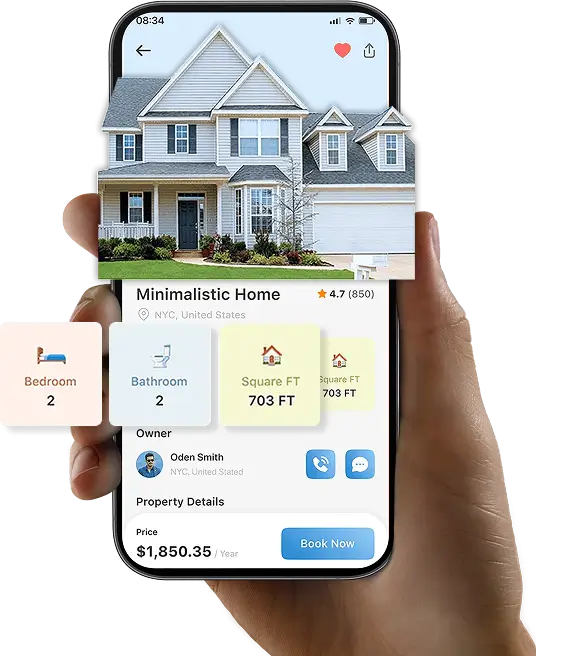

Augmented Reality (AR)

AR can assist in visual inspections for property claims or vehicle damage, allowing adjusters and customers to assess the extent of the loss easily using their smartphones easily.

Data Science

The use of data science allows insurance apps to predict risks, detect anomalies, and generate insights that drive business growth and optimize decision-making.

Internet of Things (IoT)

IoT devices, such as connected cars, fitness trackers, or smart home sensors, enable insurers to track real-time data, allowing for usage-based insurance models and reducing fraud.

Big Data

Big Data helps insurance apps to handle vast amounts of structured and unstructured information. Insurers are making smart decisions, identifying risks, and creating personalized policies.